-

102-11

-

Own indicator

-

103 (419)

-

103 (305)

-

103 (own indicator)

-

103 (303)

-

102-15

Skilful identification of risks and implementation of preventive mechanisms are the foundations of an organisation’s longevity. Responsible development of PGE requires a multi-dimensional and multi-level risk management system.

PGE Group companies, like other entities from the energy sector, are exposed to risks and threats resulting from the specific nature of their operations and presence in specific market and regulatory & legal surroundings.

PGE S.A., as the Corporate Centre managing the Group, creates and implements integrated risk management architecture at PGE Group. In particular, it shapes PGE Group’s risk management policies, standards and practices, designs and develops internal IT tools to support these processes, specifies global risk appetite and adequate limits as well as monitors their levels.

In PGE Group risk management process is pursued based on the GRC (Governance – Risk – Compliance) model. It allows adaptation and integration of each of the operational areas at all levels of management.

The PGE Capital Group has consequently developed a comprehensive risk management system. The Group measures and assesses risks in the key companies of the Group. Mechanism allowing identification of areas exposed to risk and risk level measurement methods are constantly verified and developed. Thanks to that, the significant risks concerning various areas of operations are identified and kept within the assumed limits by reducing negative effects of such risks and by taking preventive or corrective measures. All identified and assessed risks relating to the Group’s current activities are recorded in the risk register (risk books) maintained by the Risk and Insurance Department in PGE S.A. Risk books reflect changes in the value of particular risk parameters along with information on implemented mitigating activities (reducing the probability of occurrence and minimising negative consequences of a risk).

Risk factors and mitigation measures

The table below presents the most significant risks identified in the PGE Capital Group together with their assessment in 2022 EOY perspective. A risk level indicates a risk’s potential financial impact on the Group’s results, and a risk prospect (trend) indicates the probable direction of risk development. Potential events determining risk assessments in the previous report are now partially described in other sections of this report as period events. The assessment of the described risks takes into account the impact of the COVID-19 pandemic that is not analysed as a separate risk.

The main risks and threats of PGE S.A. and the PGE Group are presented below along with their assessment and outlook for year 2022.

| Risk level | Mitigating actions and main tools used for the management of the risk |

||||

| low | medium | high | |||

| Risk outlook in the next period | |||||

| decrease | growth | stable | |||

|

Low level Medium level High level |

Risk does not pose a threat and may be tolerated | ||||

| Risk which needs preparation of the proper reaction based on analysis of costs and benefits | |||||

| Intolerable risk, which needs immediate and active reaction, leading simultaneously to limitation of possible consequences and of probability of occurrence thereof | |||||

|

Market and product risks Related to prices and volumes of offered products and services |

Gross margin on electricity from the production assets of the PGE Capital Group and on trading in related products – its amount results from the uncertainty as to the future levels and volatility of market prices (electricity prices and the prices of key energy products – CO2, fuels, including in particular hard coal, gas and the prices of certificates). |

Most important actions:

|

|||

| Electricity sales volumes – this risk derives from uncertainty related to the development of macroeconomic indicators affecting the demand for electricity and energy goods, including in the context of the impact of the COVID-19 epidemic and the remedial actions taken. | |||||

| Tariffs (regulated prices) – resulting from the requirement to approve rates for distribution services and electricity and heat prices for particular groups of entities. | |||||

| The Capacity Market – resulting from uncertainties related to withholding of payments from the Capacity Market and threats related to compliance with the capacity obligations of Capacity Market Units. |

1 |

||||

|

Property risks Related to development and maintenance of the assets |

Failures and damage to property – connected with the operation and degradation over time of energy equipment and facilities and protection of energy equipment and facilities against destructive factors ( including fire, effects of weather phenomena, intentional damage). |

Most important actions:

|

|||

| Investment and development – connected with strategic plans for expanding the generation, distribution and sales potential as well as on-going investments. | |||||

|

Operational risks Related to pursuing of ongoing economic processes |

Electricity and heat production – connected with production planning and negative impact of the factors that determine production capacities. |

Most important actions:

|

|||

| Fuel management – connected with uncertainty regarding the costs, quality, timeliness and volumes of fuel supply (mainly coal) and production raw material as well as the effectiveness of inventory management processes. | |||||

| By-products and services – related to the management of production waste. | |||||

| Cybersecurity – the risk of deliberate disruption of the proper functioning of the information processing and exchange space created by IT systems operating at the PGE Capital Group. | |||||

| Procurement – related to the ineffectiveness and uncorrectness of the purchasing process. | |||||

| Employee safety – related to lack of ensuring safe working conditions. | |||||

| Human Resources – pertaining to difficulties in provision of personnel with the relevant experience, competences and ability to perform specific tasks. | |||||

| Social dialogue – related to the failure to reach an agreement between the Group’s management and the social partners, which could lead to strikes / collective disputes. | |||||

|

Regulatory and legal risks Related to compliance with external and internal legal provisions |

Legal changes in support systems – connected with uncertainty as to the future shape of the support system for production of energy. |

Most important actions:

|

|||

| Environmental protection – resulting from industry regulations specifying which „environmental” requirements energy installations should meet and what are the principles for using the natural environment. | |||||

| Climate – commitments on the EU and national level and under strategic objectives arising from the EU’s climate and energy policy. | |||||

| Concessions – resulting from the statutory requirement to hold concessions with regard to conducted operations (Risk level and outlook based on KWB Turów’s current situation). | |||||

| Taxes – related to uncertainty surrounding the future shape of tax regulations and their interpretation. | |||||

|

Financial risks Related to finance management |

Credit risk – connected with the counterparty default, partial and/or late payment of receivables or a different type of breach of contractual conditions (for example failure to deliver/collect goods or failure to pay for any associated damages or contractual penalties). |

Most important actions:

|

|||

| Liquidity risk – connected with the possibility of losing the ability to meet current liabilities and obtaining financing sources for business operations. | |||||

| Interest rate risk – resulting from the negative impact of changes in market interest rates on PGE Group’s cash flows. | |||||

| Foreign exchange risk – resulting from negative impact of exchange rate movements on PGE Group’s cash flows denominated in currencies other than domestic currency. | |||||

2The change in risk outlook results from, inter alia, growing personnel and material costs and the availability of these resources for repairs of machinery and equipment damaged due to breakdowns and failures.

3The change in risk outlook is due to, inter alia, the market situation in production fuels. Threats result from limited supplies and rising costs of purchase.

4The change in risk level derives from risks related to the ability to maintain inventories of fuel and raw materials at an appropriate level, the impact of this on production capacity and potential penalties that may be imposed on the company by the President of the Energy Regulatory Office for this reason.

5Aside from the aforementioned market situation (limited supply of fuels and production raw materials), risk outlook is influenced by an adverse situation in the area of transport services and unfavourable delivery terms being imposed.

6Change in outlook to stable resulting from continued attention to high standards of workplace safety, including compliance with applicable regulations.

7The change in risk outlook results from, inter alia, credit exposure, rising costs of electricity and heat purchases, posing a threat to timely payments by counterparties, as well as an elevated risk of insolvency.

8The change in risk outlook derives from rising costs of electricity and heat generation, which reduce margins in the District Heating segment and Conventional Generation segments, which in turn impacts financial liquidity of the company.

9The change in risk outlook is correlated with rising interest rates.

10The change in risk outlook is due to a higher exposure to changes in currency exchange rates caused by the geopolitical situation and swings in international markets, which directly impact the cost of CO2 emission allowances, among other things.

Medium-term outlook – investment risks

The description of risks, threats and limitations in the medium term concerns the most important investment initiatives implemented in the PGE Group, which have a significant impact on the direction of the Group’s development. The main obstacles to their implementation and the potential effects of delays are identified. The time horizon of undertakings varies, depending on the specific task. It ranges from approx. 2 years for PV projects to approx. 5 years for offshore wind farms.

Long-term outlook

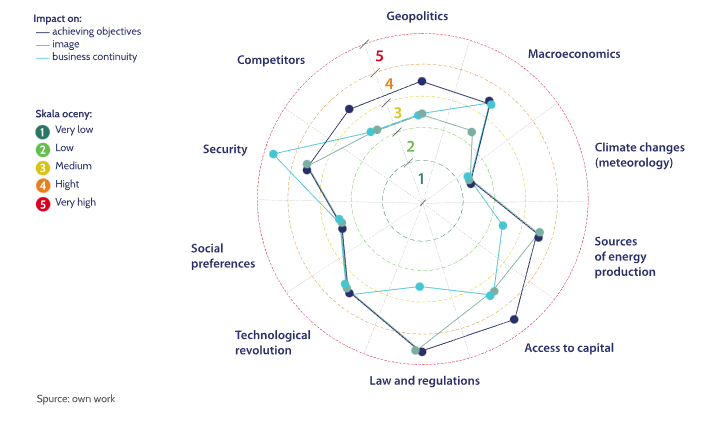

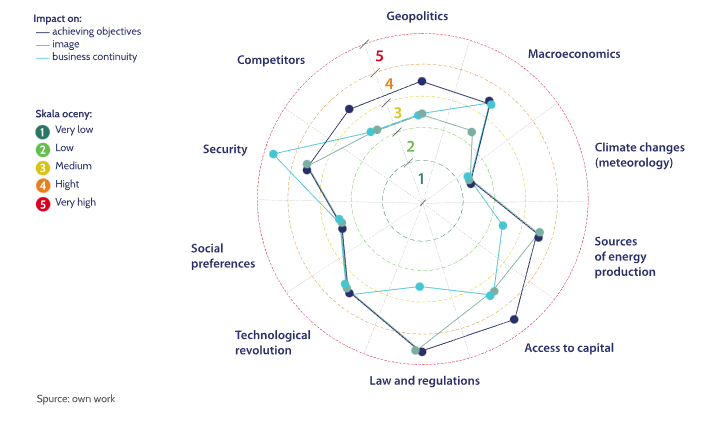

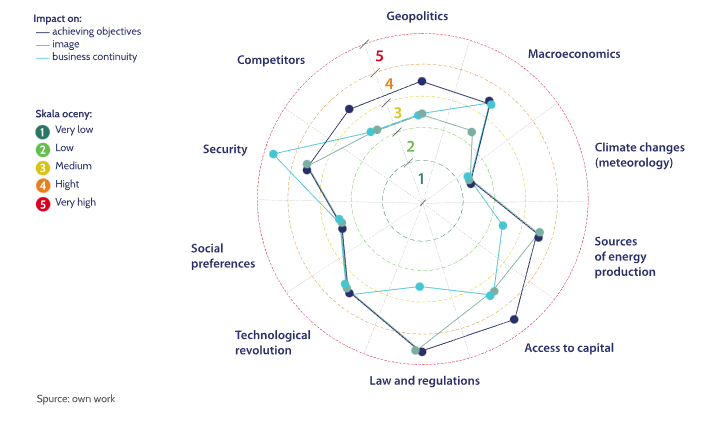

The purpose of the assessment is determined by the challenges and threats that will arise for the PGE Group in the next decade. Each of the long-term risks is assessed in terms of its impact on the achievement of business goals, the company’s image and business continuity. The presented result is the dominant (value most often appearing in the results) of these three aspects.

Risk stemming from changes in geopolitical factors and trends (e.g. EU politics, diverging interests, war in Ukraine), causing limited access to raw material supply for PGE Group.

Risk resulting from changes in economic situation, causing swings in macroeconomic indicators and commodity and fuels prices that have impact on PGE Group’s activities (economic changes that may affect the deterioration of the financial ratios of PGE Group companies).

Risk deriving from physical hazards related to the occurrence of extreme weather events and an increase in their frequency, as a result of which the PGE Group’s assets may be damaged, as well as climate changes affecting the demand for electricity and heat.

11 It concerns only physical phenomena, it does not take into account the EU climate policy. The context of climate risks is described in the next section.

Risk associated with failure to develop generation resources from new energy sources at the expected volume (energy and heat).

Risk associated with failure by PGE Group to raise capital for planned investments.

Risk associated with changes in the legal system and regulatory uncertainty, including unexpected changes such as the future shape of support systems, regulatory burdens resulting from environmental requirements having an impact on PGE Group.

Risk arising from technological development, which has a considerable impact on the direction of changes on the energy market, including as to the ways of generating energy.

Risks resulting from an expected further evolution of social preferences towards care for the environment, sustainability and social responsibility, in terms of mass customer expectations, assessment of employer attractiveness and public opinion, which may affect PGE Group.

Risk associated with a negative impact of the geopolitical situation on both physical security and cybersecurity to PGE Group’s business, including intentional disruption of the correct functioning of information processing and exchange space created by IT systems in place at PGE Group (interference in any element of PGE Group’s infrastructure resulting in disruption of work of ICT (Information and Communication Technologies) and OT (Operational Technology) infrastructure and as a consequence – disruption of work of a process supported by this infrastructure).

Risk resulting from structural changes in the energy sector, affecting the competitive environment of PGE Group (e.g. building competitive advantage through distributed sources, development of the prosumer market, development of competitors’ product offerings and their structural strengthening on the energy market).

Contrary to the risks of current operations, The assessment of long-term risks was performed in scenario taking into account the spin-off of coal assets from the PGE Capital Group, assuming the foundation of NABE. The location on the map based on the assessment (significance level) shows the impact of a given risk for the PGE Capital Group in three different aspects, successively affecting the achievement of business goals, the company’s image and business continuity.

The map of long-term risks was prepared based on the elements dominating in the responses, according to the subjective perception of the development of these risks in the assessments of the top management of the PGE Capital Group (Management Board Members and Division Directors).

Climate risks

-

201-2

-

103 (307)

-

103 (306)

At PGE Group, climate risk is analysed both in the context of the impact of climate change on business as well as the impact of business on climate change. Impact on climate is managed and minimised by identifying and analysing climate-related risks and continuously improving pre-environmental solutions and control tools, while ensuring financial performance for PGE Group. The solutions developed by PGE Group are aimed at its development and sustainable transition in line with climate requirements and with concern for all stakeholders.

Climate risk issues are subject to rigours and guidelines originating from the corporate risk management process. The President of the Management Board of PGE Polska Grupa Energetyczna, Wojciech Dąbrowski, is responsible for oversight of issues related to the reduction of PGE Group’s impact on climate. The Risk Committee is responsible for supervising the risk management process at PGE Group with regard to financial and non-financial risks (including climate risk). Having a Risk Committee at the highest management level that reports directly to the Management Board ensures supervision over the effectiveness of risk management processes across the entire Group. Defining this function as part of the enterprise risk management framework allows for an independent assessment of individual risks, their impact on PGE Group and the mitigation and control of material risks using dedicated instruments.

The approach to the issue of climate risks is inspired by the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), however, the adopted method of inventory and risk assessment, and the assumptions adopted, are an internal PGE concept.

PGE Group defines climate risk across five areas:

- raising support funds and investment incentives in national regulations – related to the growing impact of climate requirements relevant to the granting of aid funds and investment incentives in national regulations,

- international regulations – related to EU legislation as regards energy and climate policy, in particular the Fit for 55 package,

- CO2 emissions – related to the rising costs of emission allowances, which could adversely affect the profitability of generating assets or bring these assets to a halt,

- operations – related to extreme weather events or changes in climate conditions, which could negatively influence PGE Group’s assets and operating activities,

- investments – concerning a failure by PGE Group to fulfill investment commitments aimed at the green transition, at the EU and domestic level and for own strategic purposes, which could adversely influence PGE Group’s operational capacity, financial standing and reputation.

Each of these areas of climate risk is assessed in:

- the short term (year 2022),

- medium term (2022-2026) and

- long term (2022-2030).

For all terms, the climate risk was assessed as high.

Risks arising from the possibility of non-compliance with environmental requirements at companies: PGE Energia Ciepła, PGE Górnictwo i Energetyka Konwencjonalna and PGE Energia Odnawialna, were assessed in 2021 as the most material across the Group and entered the stage of in-depth analysis.

Strategic opportunities

PGE focuses not only on the negative aspects of the risks analysed, rather treating them as challenges and taking advantage of the opportunities presented by the dynamically changing conditions in which PGE Group operates. Such an approach allows us to build and develop our position on the market. Effective implementation of solutions developed in the Group translates into more efficient management of the Group’s resources across the entire value chain and enhances the quality of energy services provided.

Thanks to dedicated investment support aimed at developing specific production sources (such as RES or co-generation), PGE can effectively change electricity or heat energy production technologies, in terms of investment expenses, and thus reduce the level of exposure to such factors as prices of emission allowances or fuel.

We consider energy transformation not only as a risk, but as a development opportunity for the organisation. The main identified opportunities are:

PGE Group will be a pioneer in the development and operation of offshore wind assets in Poland. The delivery of these investments will unlock stable revenues thanks to a dedicated support system and the build-up of the Group’s generating potential. The development of offshore wind farms will contribute to a significant increase in the capacity generated from renewable energy sources in the Polish energy mix. This will accelerate Poland’s energy transition towards climate neutrality and increase its independence from energy imports and the raw materials necessary for energy production. Energy generated by PGE’s offshore wind farms will be sufficient to power around 4 million households annually. The investment will create new jobs at the following stages: development (development phase), construction and operation of the Baltica 2 and Baltica 3 farms. As part of communication with the local community, we support initiatives within the municipality where the connection point of the offshore wind farms to the National Power System is located (SE Choczewo). This Project will contribute to the economic development of the coastal areas, e.g. through the construction of an installation port to support the construction phase of Polish offshore projects and the development of a dedicated service and operation port for the maintenance of the Project during its operation phase. The local content indicator is expected to be maximised in the course of building up the supply chain for these offshore wind farms, which is aimed at involving Polish entities as much as possible in terms of participation in the supply and installation of offshore wind farm elements. The Baltica 2+3 Project is the first offshore wind project on the Polish market, being developed in parallel with other projects that received support in the form of a contract for difference under Phase I of the Offshore Wind Farm Support Act. The delivery of offshore wind farm projects will be the most important step towards achieving the strategic goal of zero-carbon by 2050 and 100% green energy for PGE customers.

PGE Group is pursuing an ambitious photovoltaic development program, aspiring to deploy 1,200 MW of PV capacity by 2024 and >3.0 GW of new capacity by 2030. Development will take place on the basis of a support system and long-term contracts, which will make it possible to secure an expected rate of return and revenues from electricity sales over the long term. It will also enable the Group to develop and diversify its generating portfolio. Photovoltaics is one of the fastest growing segments of the energy industry in Poland. By the end of May 2022, the capacity of photovoltaic installations exceeded 10.2 GW, an increase of 100% in a single year. The assumptions of PGE Group’s strategy are not just on paper, but are being actively implemented, inter alia, through the dynamic development of PV projects. Using the support mechanism, 19 projects with a total capacity of approx. 18 MW will be implemented, which won the 2021 auction for the sale of electricity in renewable energy installations up to 1 MW. The investments will be built in the Zachodniopomorskie, Wielkopolskie, Lubuskie, Łódzkie, Lubelskie and Mazowieckie voivodeships. In December 2021, PGE Energia Odnawialna received a permit for the construction of one of the largest PV farms in Poland with a total capacity of 100 MW. The project, consisting of two installations – PV Jeziórko 1 and PV Jeziórko 2 – will be put into service by the end of 2023 in the Grębów municipality in the Tarnobrzeg district of Podkarpacie. In June 2022, PGE Energia Odnawialna signed agreements for the construction of four more photovoltaic farms. PV installations of five, six and eight megawatts will be built in the Mazowsze and Podlasie regions. The PV farms will be put into operation in the first quarter of 2023 on private land leased by the company in the Grajewski and Łosicki districts. In the first case, the PV Gutki 1 and PV Gutki 2 farms will each have six megawatts of power. PV Huszlew 1 and PV Huszlew 2 will have five and eight megawatts of power respectively. The total output of all of them could exceed 20 GWh, which is the amount consumed by an average of 8,000 households. To date, PGE Energia Odnawialna has secured approx. 3,000 hectares of land on which photovoltaic farms with a capacity of more than 2,000 MW can be built. In addition, in 2021 the company obtained planning permission for new projects with a total capacity of nearly 200 MW. This process will further accelerate in the coming years, allowing PGE to tender for 300-400 megawatts of solar PV each year.

The energy transition towards distributed sources, including prosumer sources, and dynamisation in the energy market requires additional investments in distribution grids, including smart infrastructure. Investments made under the tariff model should allow PGE to increase the share of regulated revenues, which is desirable given the need to raise capital for growth and build a financially stable organisation. In 2022, PGE conducted a series E share issue raising approx. PLN 3.2 billion. A portion of these funds will be earmarked for the “Distribution of the Future” project. The objectives of this project are:

-

Increasing the share of cable lines in PGE Group’s MV grid (funds from share issue – PLN 0.61 billion)

The process of gradually increasing the share of underground cable lines in the structure of the MV network will allow the SAIDI indicator to be reduced, thus improving the quality of distributed energy. This will result in the reduction of operating costs and optimisation of operations (minimisation of lost benefits from undelivered energy, decrease in costs incurred for network operation, reduction of network loss costs) -

Development of remote reading meters (funds from share issue – PLN 0.74 billion)

The program assumes faster implementation of remote reading meters than regulatory requirements. Accelerating the timetable allows benefits to be realised more quickly for both the company and customers. Benefits of remote reading metres development for PGE Group:- The program provides for the replacement of end-user meters and the reconstruction of MV/LV substations in this area

- Reduction of OPEX

- Adopting a more ambitious implementation timetable will allow the level of meter replacement to be set in the long term

- Reinvestment bonus

- Providing a better standard of service will have a positive impact on customer perception

-

Increasing the efficiency of connection processes (new customers and new sources) (funds from share issue – PLN 0.26 billion)

Energy transition requires new connection capacities. The program envisages the modernisation of the grid to reduce congestion, increase connection capacities and speed up connection processes. With the funds raised from the share issue, it will be possible to build an additional 1,200 km of connections and 800 MW of additional connection capacity for RES sources by 2023. From the perspective of the customer and the dynamically growing number of micro-installations, this will mean an additional 18 000 connections and a reduction in the average time to connect a new customer to <200 days in 2023 (compared to the previously expected 257 days).

Other opportunities include.

1 GW of new capacity by 2030, including through acquisitions. A faster delivery of this target will be possible in particular if current regulations (the so-called 10H Act) are relaxed. In 2022, PGE increased its onshore wind portfolio with the acquisition of three wind farms with a capacity of over 84 MW.

This project is intended to combine the existing 716 MW Żarnowiec pumped-storage plant with a battery electricity storage system of no less than 200 MW and a capacity of over 820 MWh. The resulting innovative hybrid installation with a power rating of at least 921 MW and a capacity of more than 4.6 GWh, equivalent to the capacity of the largest conventional units in Poland, will be able to provide a full range of regulatory system services and serve to restore the energy system. The electricity storage facility will avoid emissions of approx. 1 million tCO2e in absolute terms, but will also contribute to increasing the flexibility of the NPS and improving the energy security of the country, especially the northern region of Poland. It will also ensure the integration, optimisation and flexibility of the operation of ESP Żarnowiec.

Expanding the product portfolio to include products that are aligned with low-carbon heating systems, PV sales, heat pump sales and activities to promote and support the development of these systems (PV insurance). This initiative is dictated by the changing market, the observation of European trends, the energy transition, the reorientation of customers towards eco products and by preparations for the RED II directive. The product portfolio and contract/product documentation have been adapted to changing regulations and the evolving needs of customers and business partners. For PGE Obrót customers, we are implementing offerings promoting low-emission heating systems (sale of heat pumps – “Heat pumps with PGE”, sale of photovoltaics – “Photovoltaics with PGE”). Future solutions also include energy storage facilities and energy cooperatives.